Mint Bank Account Asking for Registration Code Again

A lot of the states would accept gone through this. Y'all wake upward in the morning and check your letters and run into that at 2.30 AM Rs xx,000 has been spent on your credit card for iii lace wigs from a section shop in Houston, Texas. But the but problem is, you are in New Delhi, at 2.30 AM you lot were fast comatose, and you have never even idea most ownership a wig, let alone three.

Such instances of cyberbanking fraud is condign all too mutual in Republic of india. With Prime Minister Narendra Modi pushing for a less greenbacks economic system, information technology becomes all the more than important to fix the problem of digital frauds.

Keeping this mind and seeing a rise in customer complaints regarding unauthorised electronic transactions, the Reserve Banking company of India (RBI), in July, released new rules which makes it safer for customers to transact electronically.

On July half dozen, 2017, the RBI issued a notification, Customer protection - limited liability of customers in unauthorised electronic banking transactions. The good news is that the onus is on the banks to prove that a fraud has taken identify, but customers should inform the bank as soon as possible to avert existence penalised.

What banks have to do

According to the notification, "the systems and procedures in banks must exist designed to make customers feel safe most carrying out electronic banking transactions." Banks must inquire their customers to mandatorily register for SMS alerts and wherever bachelor register for e-mail alerts. Further, banks accept been told to not to offer the facility of electronic transactions, other than ATM cash withdrawals, to customers who do not provide mobile numbers.

Banks also take to inform customers that they should notify the bank as soon as possible of any unauthorised electronic transaction and that the longer they have to notify the bank, the college will be cost they have to pay.

Now let us take a look at what the customer has to practise:

Zero liability of a customer

If the fraud happens due to negligence from the bank's finish, the client obviously is not liable. For instance, if there is a glitch on the backend of the bank where client details are compromised, then you will not be liable to pay. Or if bank employees are involved in fraudulent activities where they give away client details. The RBI notification states that if a 'tertiary-party' breach happens when neither the bank nor the customer is at fault, and the customer informs the bank within three working days, here, besides, the customer is not liable to pay.

Who is a third-party you may ask. Well, scammers and fraudsters are getting more creative by the day. It tin can happen at an ATM (skimming, menu trapping etc.), by using public Wi-Fi, malware in ATMs or banking concern servers, at merchant outlets where you swipe your credit or debit carte du jour, or even on your ain figurer (using ways like pharming and so on).

Then, to protect yourself and your coin, the first step is make sure you apply for the SMS and email alerts service of your bank. The second footstep would be to intimate the bank as soon as you lot get the alert that coin has been debited from your account. Practise information technology within three days. If you do not, then depending on how long y'all take, your liability increases.

Limited liability of a customer

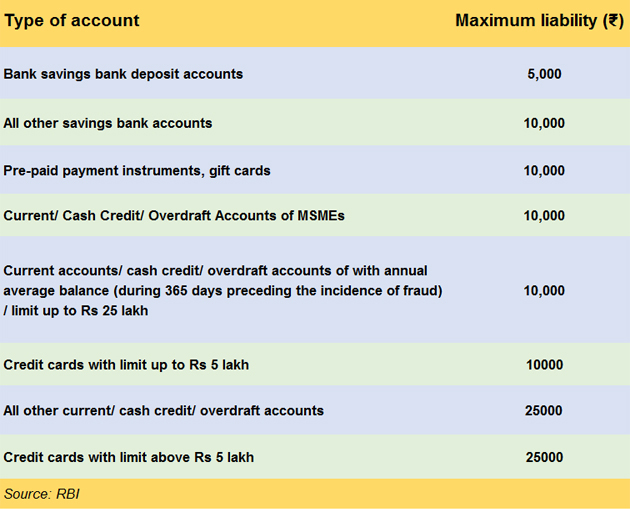

Now if the bank is at fault, yous do not pay, but if the fraud or wrongful debit has happened because of your negligence, then y'all will take to carry the burden. This could happen if you mentioned your PIN number or password in passing or left it lying around and someone used it without your knowledge. The proficient news is that even though this transaction has happened due to your negligence, if you report it to the bank earlier seven working days (and after three days) from receiving the debit message, the RBI notification says that the per transaction liability of the customer will be limited to the transaction value or an corporeality set by the central bank, whichever is lower.

And if you take more than vii days, "the customer liability shall exist determined as per the bank'south Lath canonical policy," says the RBI notification.

How long volition it take for the reversal?

Banks accept to credit or reverse the unauthorised electronic transaction to the client'southward account inside 10 working days from the date of notification by the customer. And once reported, in case of debit card or bank business relationship fraud, the bank should ensure that the customer does not suffer loss of interest. If the transaction has happened on a credit carte, the customer should not take to boosted burden of involvement.

Also, once reported, banks take to resolve the example within 90 days from the engagement of receipt of the complaint.

Systems to exist put in place by banks

RBI's circular has said that banks must provide customers 24/7 access through multiple channels like SMS, electronic mail, IVR and so on for reporting unauthorised transactions. A new facility that banks take been asked to provide is that of allowing customers to "instantly respond past "Answer" to the SMS and email alerts and the customers should non exist required to search for a web page or an eastward-mail address to notify the objection".

What should you practice?

Banking frauds are on the ascent and RBI has released information in March of this year which corroborates this fact. In full there were three,870 cases of fraud worth Rs 17, 750 crore. Our lives will only get more reliant on applied science and tricksters will simply come upward with more than innovative ways to steal our hard earned money. And so, have the necessary precautions and do not requite out your bank or credit card details to anyone who you do not trust and - we cannot stress this fact plenty - inform the bank as presently you get to know of a wrongful transaction in your account.

Quondam, RBI governor, Raghuram Rajan, in his volume, I do what I do, wrote that "applied science tin can magnify the reach of finance bad purposes equally well every bit practiced." He goes on to say talk nearly tricksters sending emails supposedly from him asking customers to collect large sum of coin from the RBI by only giving them their bank business relationship details. This is a clear case of phishing. "Let me clinch you lot that RBI does non give out money, I practise not send out these emails, and if y'all do fall for these emails, you lot will lose a lot of money to crooks and be reminded of the aphorism - if it looks also good to be truthful, information technology probably is not true," wrote Rajan.

Source: https://economictimes.indiatimes.com/wealth/save/has-your-bank-account-been-debited-for-a-transaction-you-havent-done-read-this/articleshow/61577976.cms

0 Response to "Mint Bank Account Asking for Registration Code Again"

Post a Comment